CSCO Earnings: Cisco Systems’ Stock Rises on Strong Financial Results and Upbeat Guidance

Cisco Systems’ (CSCO) stock is rising after the telecommunications equipment maker reported financial results that topped Wall Street forecasts and issued bullish forward guidance.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

The Silicon Valley-based company announced earnings per share (EPS) of $0.96, which was ahead of the $0.92 expected among analysts. Revenue in the quarter ended April 26 totaled $14.15 billion, which beat the $14.08 billion anticipated on Wall Street. Sales rose 11% from a year earlier.

Looking ahead, Cisco’s management team delivered a bullish outlook, saying they expect EPS of $0.96 to $0.98 for Fiscal 2025 on $14.50 billion to $14.70 billion in revenue. Analysts had earnings of $0.95 and sales of $14.58 billion penciled in for the company.

Cisco executives said the guidance factors in the expected impact of U.S. President Donald Trump’s tariffs on goods imported into America.

Cisco’s income statement. Source: Main Street Data

AI Impacts

Cisco reported over $600 million in artificial intelligence (AI) infrastructure orders from customers during the quarter. That brings the total for the Fiscal year to over $1.25 billion. Cisco said the value of its AI orders surpassed the $1 billion mark a quarter ahead of schedule.

Cisco’s networking revenue rose 8% to $7.07 billion in the quarter. That was ahead of analysts expectations for $6.81 billion. Revenue from security products skyrocketed 54% higher to $2.01 billion, which was actually below the $2.17 billion consensus forecast on Wall Street.

During the quarter, Cisco Systems started selling a Webex AI agent for customer service. CSCO stock has risen 5% on the year.

Is CSCO Stock a Buy?

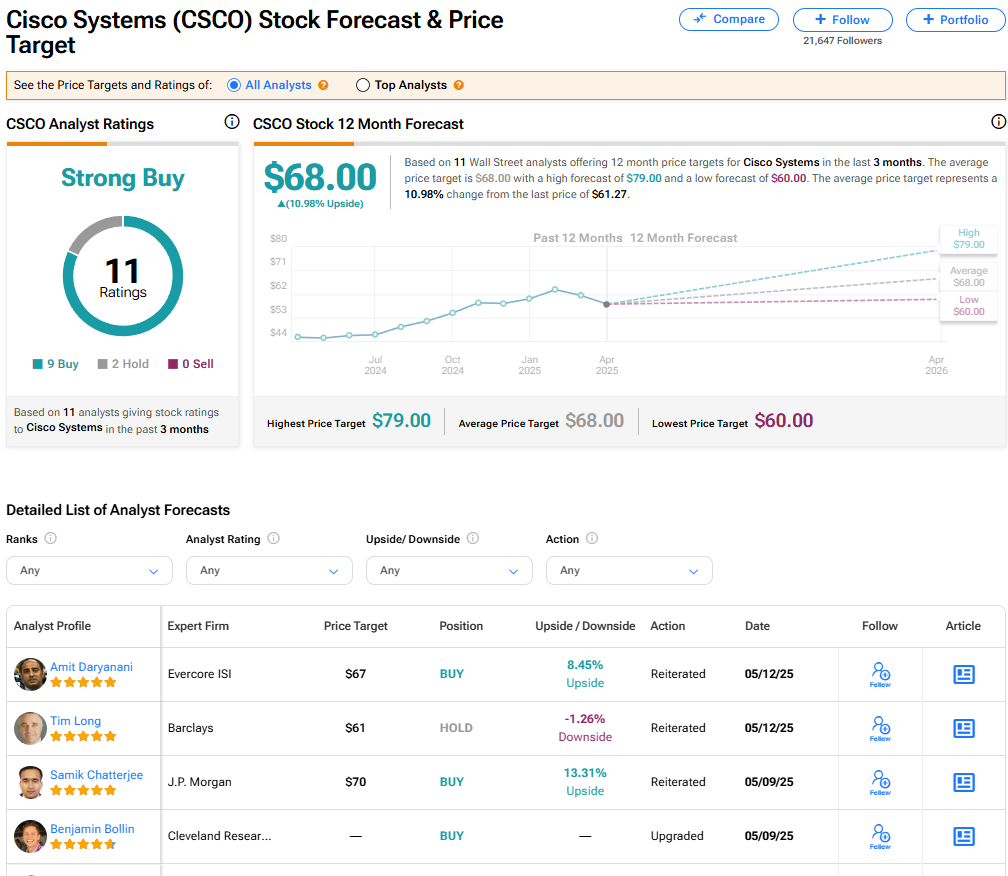

The stock of Cisco Systems has a consensus Strong Buy rating among 11 Wall Street analysts. That rating is based on nine Buy and two Hold recommendations issued in the last three months. The average CSCO price target of $68 implies 10.98% upside from current levels. These ratings are likely to change after the company’s financial results.